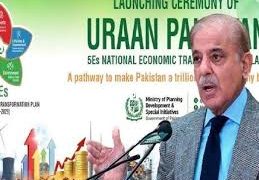

Prime Minister Shehbaz Sharif on Tuesday called for measures to broaden the tax net, directing the authorities to take strict action against individuals and sectors involved in tax evasion.

The Federal Board of Revenue (FBR) missed its collection target by nearly Rs831 billion in the first 10 months of the current fiscal year, mainly due to a decline in import volume and lower-than-expected inflation, which hit sales tax collections. The tax body collected Rs 2.299 trillion in July-April FY25 against the budgetary target of Rs 10.130tr. On monthly terms, it collected Rs846bn in April against the target of Rs963bn, which indicates a gap of Rs117bn.

The prime minister, chairing a review meeting on broadening the tax base and increasing tax revenue, said that the individuals and sectors capable of paying taxes must be brought into the tax net.

He also instructed the stringent accountability of officers and personnel assisting the tax evaders, according to a statement by the PM Office.

The meeting was informed that the tax revenue target equivalent to 10.6 per cent of GDP would be attained as a result of reforms in the FBR.